Spotlight series

Explore our Spotlight series, a deep dive into the dynamic world of payment acceptance and real-world applications including real-world scenarios of how we’ve helped our customers.

Sheeva.AI: helping in-car commerce reach consumers faster

Sheeva.AI is a leading innovator at the cutting-edge of in-car payments and services, a technology that’s going to change the way we pay for vehicle-related services like fueling, charging, parking, and tolls forever. We’ve been collaborating with Sheeva.AI on the payments part of the process, implementing an innovative and secure tokenization service in this new and emerging space.

Delivery services: payments in action

Consumers want easy, fast delivery, no matter how or where they are ordering and paying. See how the future of deliveries starts with the opportunities that payments can open for your business.

Get on board the world’s open payments platform

In urban mobility, payment innovation is picking up speed. Learn more on how digital payments enable transit operators to optimize revenue, fight fraud, and encourage transit use with a wealth of data insights.

Take flight with Visa Acceptance Platform

In the aviation industry, the power of payment innovation is soaring over new heights. Discover how digital payments empower airlines by fortifying their defenses against fraud and expanding opportunities for customers, all while reshaping the future of air travel.

Reports and guides

Review detailed, quantitative and qualitative insights into customer behaviors, changes in the payments industry, and current fraud trends.

2025 Global eCommerce Payments & Fraud Report

The 2025 Global eCommerce Payments & Fraud Report, produced by the Merchant Risk Council along with Visa Acceptance Solutions and Verifi, surveyed merchants of all sizes from around the world to offer valuable insight into current payment acceptance and fraud trends.

2025 Global Digital Shopping Index

The 2025 Global Digital Shopping Index introduces you to the rise of the mobile window shopper—who they are, how they use their phones to shop, and how they’ve transformed retail into an anywhere storefront. Understanding how online and in-person shopping preferences are changing is crucial for businesses to ensure repeat business from their customers.

A SaaS platform’s guide to online payments

Incorporating payments into your business model can be a complex task for any SaaS platform. But it not only creates an additional revenue stream, it can also enhance your value proposition. Our region-specific guides can help you understand the benefits of incorporating payments into your business, explore different models, and choose the right one.

Product snapshots

Learn about our products’ features and functionalities and how they can support your business goals.

Acceptance Devices

From small businesses that need a simple cost-efficient standalone solution to middle and large sellers that need an integrated card-present payment terminal, Acceptance Devices is a complete full-stack solution to help you serve customers anytime, anywhere.

Acceptance Devices | Terminals

Built on our powerful payments platform, our solution includes pre-certified, pre-integrated terminals for countertop, mobile, and portable in-person environments, so you can accept payments across multiple channels. These next-generation terminals support popular payment methods, including contactless and chip cards, ensuring your customers have a convenient and secure experience.

Acceptance Devices | Tap to Phone

Our Tap to Phone cloud-based solution lets you accept contactless card payments using smartphones or tablets, eliminating the need for a separate card reader device. It’s a quick and convenient way for small businesses and mobile merchants to accept payments.

Token Management Service

Consumers expect personalized, frictionless payment experiences, and as digital commerce grows, meeting these needs now and in the future should be a top priority. Token Management Service not only protects sensitive payment information through tokenization but also secures and manages customer payment data across payment networks, types, and channels.

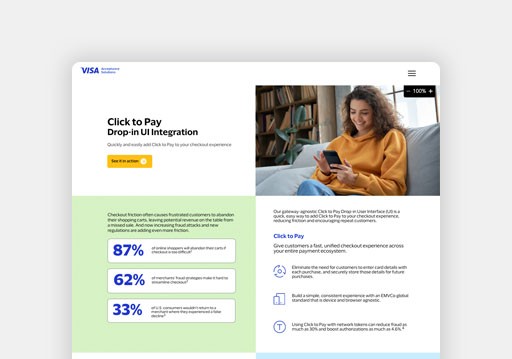

Click to Pay Drop-in UI Integration

Give customers a fast, unified checkout experience across your entire payment ecosystem. Our gateway-agnostic Click to Pay Drop-in User Interface (UI) is a quick, easy way to add Click to Pay to your checkout experience, reducing friction and encouraging repeat customers.

Mobile Software Development Kits (SDKs)

Mobile SDKs provide a convenient way to accept and secure payment information provided by your customers during a payment flow. Sensitive payment data never touches your backend system, helping to reduce your PCI compliance scope and increase your customers’ security.

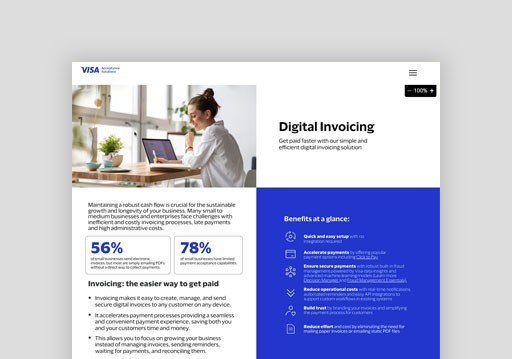

Digital Invoicing

Invoicing makes it easy to create, manage, and send secure digital invoices to any customer on any device. It accelerates payment processes, providing a seamless and convenient payment experience, saving both you and your customers time and money and allowing you to focus on growing your business instead.

Service Orchestration

Service Orchestration’s powerful machine learning and artificial intelligence models analyze data from 200+1 processor and acquirer connections during processing to determine and use the route most likely to approve a transaction, recommend actions to help maximize a transaction’s chance of approval, or suggest whether or not to retry.

Payer Authentication for EMV 3-D Secure

Catching more unauthorized card use earlier in the transaction process can lead to fewer chargebacks, higher authorization rates, and a more secure cardholder experience. Payer Authentication helps make that possible by using the EMV 3-D Secure protocol to authenticate customers’ identities before their payments are authorized.

Card Present Connect

Card Present Connect helps you connect internet-ready POS devices into the Visa Acceptance Platform through a single integration for card-present processing connectivity and access to other value-added payment services—all available from a powerful payment management platform that optimizes the process for you from start to finish.

Industries

Dive into the diverse sectors Visa Acceptance Solutions serves, showcasing our payment solutions tailored to meet the unique needs of each industry.

Industry trends update: retail evolution—payment preferences, physical stores, and social commerce

Our latest Industry Trends Update brings you analyst viewpoints on consumer payment preferences, physical stores, social commerce, and more; and explains how Visa Acceptance Solutions fits in.

How can payments help transit operators take a new route for growth?

In the dynamic world of urban mobility, the wave of digital payments innovation is not just picking up speed, but it is also transforming traditional business models and heralding a new era of growth. The rise of digital payments is more than just streamlining transactions; it is a powerful tool for transit operators to optimize revenue, fortify their defenses against fraud, and foster transit use through insightful data.

The next generation of urban mobility: How do payments help fast-track your revenue?

In the world of urban mobility, digital payments are swiftly reshaping traditional business models and propelling a new era of growth. Digital payments are more than just a tool for streamlining transactions; they can offer transit operators the opportunity to increase revenue, safeguard against fraud, and encourage transit use through insightful data.

How can payments improve passenger experiences for urban transit operators?

The rise of digital payments is ushering in a new era of growth in urban mobility. More than just a tool for streamlining transactions, digital payments offer transit operators the opportunity to increase revenue, safeguard against fraud, and encourage transit use with insightful data.

Videos

Enhance your payment success with Visa Acceptance Solutions

Visa Acceptance Solutions enables payments orchestration by increasing sales with successful transactions through our Service Orchestration offering. Learn how we use AI to help businesses optimize authorizations, reduce false declines, and deliver exceptional customer experience without compromising fraud protection.

Transform payment acceptance with AI and Visa

AI is transforming payment acceptance by reducing fraud and providing valuable customer insights. See how Visa Acceptance Solutions uses AI-based strategies to help businesses detect and prevent fraud while delivering seamless payment experiences.

Boost approval rates with AI-driven Visa Acceptance Solutions

Visa Acceptance Solutions uses AI to boost approval rates, enhance revenue growth, and improve customer experience while maintaining robust fraud prevention. Learn how AI-driven features can lead to seamless payment moments that help businesses build customer loyalty.

Enhance approvals and revenue with Visa's big data solutions

Visa harnesses big data to help businesses enhance approval rates and customer experiences, driving increased revenue growth. Learn how our approach to data enrichment can reduce false declines, boost repeat business, and improve brand reputation.

Equip yourself with solutions that enable dynamic payments and robust growth for your business, all while keeping your customers happy.

1 Represents the total number of processors/acquirer connections that Cybersource sent authorization transactions to in the calendar month ending July 31, 2023.